By Tom Rimmer for Financier Worldwide

It comes as no surprise that the pandemic has taken its toll on financial institutions (FIs). Banks are always on the lookout for ways to cut costs to improve their operational margins. The lockdown, though, has seen FIs having to rapidly invest in technology to align with remote working practices. In some cases, it was the first time these businesses had all staff working remotely, which only added to their compliance challenges. With changing consumer demands and many still staying off the high streets because of social distancing measures, banks will increasingly need to adopt more solutions to engage remotely with customers, whether that is via the phone or through video conferencing tools.

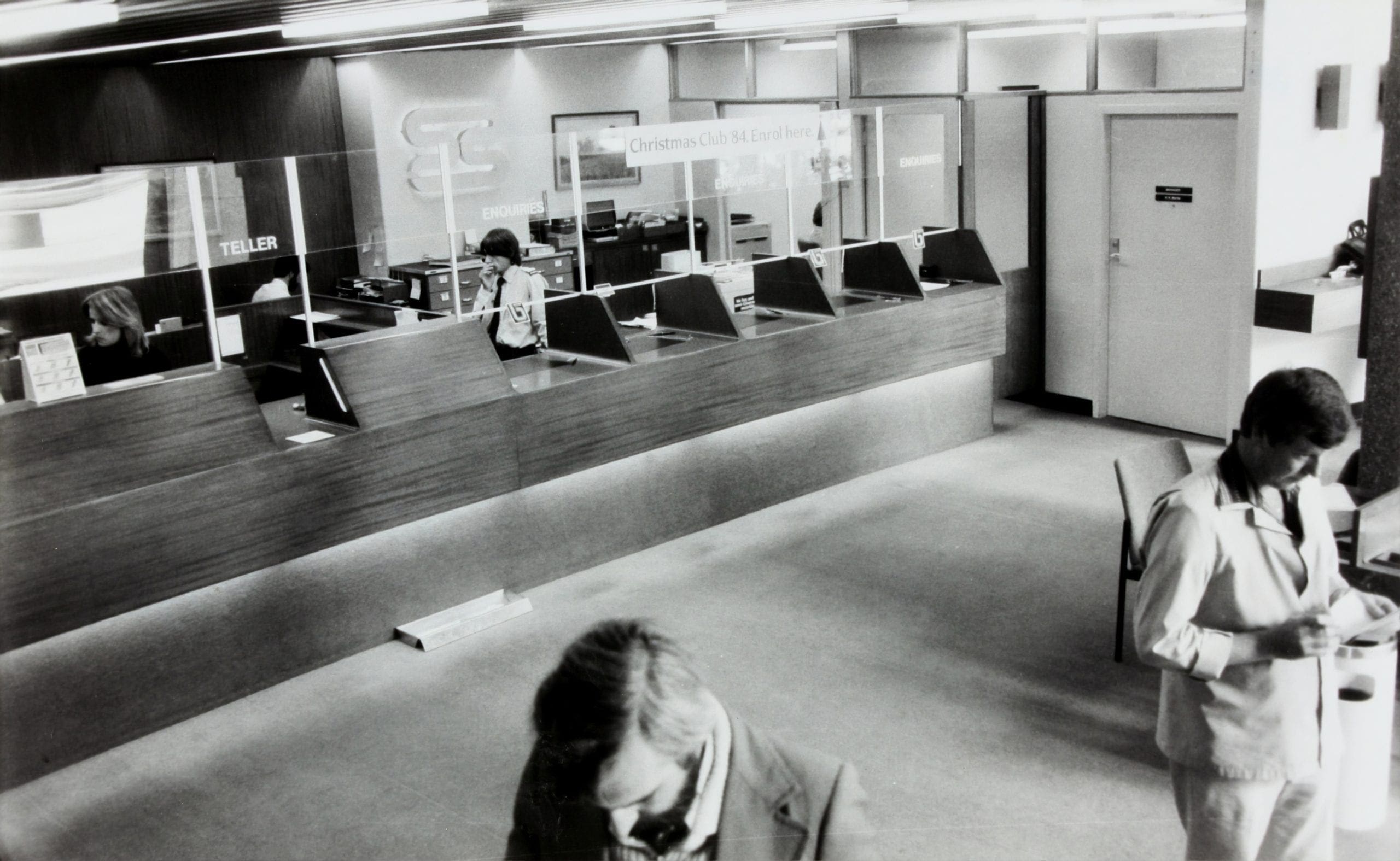

As customers transition to a more digital-first banking approach, banks are going to have to weigh up the need for human interaction and the convenience of online channels when connecting with them. Ultimately, people like to speak to other humans, especially when something is going wrong.

With fewer physical places for customers to interact with their banks in the current climate, call centres will undoubtedly find their call volumes increasing. The Banking & Payments Federation Ireland (BPFI), for example, said member banks had experienced a 400 percent increase in calls at the beginning of the crisis. The challenge then comes in how technology can aid banks in ensuring customer churn is kept low, issues are flagged immediately, and compliance needs are met.

Regulatory needs

Since the 2008 financial crisis, the number of regulations FIs face has drastically increased. With more regulations being added every year, the financial services firms that deal with personal or sensitive information encounter increasing barriers in being able to deliver their products or services. These institutions need to implement new systems and solutions to manage risk to their customers’ personal data.

This is a major task – not to mention that the ramifications of non-compliance with regulations can have a direct impact on revenues. In 2019 alone, the Financial Conduct Authority (FCA) issued over £38bn worth of fines in the UK for compliance, legal and governance-related issues.

However, fines are not the only concern. The impact on brand reputation and share prices can have a more detrimental effect overall. If an organisation faces a regulatory breach, it runs the risk of discouraging potential new customers, and losing its existing customers in the process. As brand reputation can be lost in an instant, protecting the brand is one of the most important challenges businesses face when presented with a compliance fine.

The power of voice technology

Due to the immense volume of contact centre calls, compliance has become a significant, growing challenge. FIs’ contact centres have strict regulations to follow, such as protecting credit card data (the Payment Card Industry Data Security Standard (PCI DSS)) and protecting customer data (the General Data Protection Regulation(GDPR)). The FCA, through the COBS 11.8 regulation, also states that banks need to record all customer interactions. These organisations need to not only follow these rules but also need to be able to prove their compliance in case of audit.

The problem comes in where, unlike text, it is extremely challenging and time consuming to extract useful information from audio recordings. However, with the use of voice technology, FIs can easily locate and replay stored recordings automatically. They will then be able to evaluate and categorise every customer interaction into groups that are relevant to specific compliance regulations which can then be addressed appropriately.

Adding to that, as call recordings need to be easily accessible upon request, whether from a customer or the auditor, there needs to be a notetaking and more in-depth record keeping element. Through sophisticated voice technology, this is easy. The technology enables other capabilities to be facilitated, such as indexing of conversations, searchability and timestamping of calls.

Voice technology and RegTech

With an increasing amount of regulations to adhere to, the burden to understand, manage and protect customers’ voice data is more important now than ever before. Regulatory technology (RegTech) is set to make up 34 percent of all regulatory spending by the end of 2020, according to KPMG.

A key component of RegTech is voice technology, transforming the unstructured voice data into text. This can then be used to find insights and flag any compliance issues which is essential to FIs and their ability to remain compliant. Using speech recognition technology for regulatory compliance is about delivering monitoring at scale while protecting the business and its customers.

The technology not only ensures that historical archives of voice data are transcribed for analysis, but any issues or problems that happen on the call can be resolved in near real-time. The system will automatically transcribe and analyse the customer’s words, can offer prompts, information and can even suggest escalating the call to a senior staff member if needed. This capability minimises risk significantly to FIs.

Ultimately, voice technology has the potential to reduce fines, speed up investigations and protect the brand. It also saves time by enabling all voice data to be transcribed quickly and automatically, a process that before the advances in automatic speech recognition (ASR) was difficult and time consuming. This gives FIs a better understanding of their customer, which not only aids in mapping the customer journey, their interactions and changing sentiment, but also to comply with various regulations. This is essential for brand reputation, share price security and delivering a better customer service amid changing regulations.

Visit our friends over at TranscriptionGear to get the rest of what you need! From headsets to foot pedals, they have you covered.